In today’s digital age, banking has evolved beyond the traditional brick-and-mortar model, offering consumers unprecedented convenience and innovative features.

One such institution leading the charge is Oxygen Bank, a financial technology company revolutionizing personal and business banking services.

With a focus on rewarding its customers and providing seamless accessibility, Oxygen Bank stands out as a formidable player in the digital banking landscape.

In this comprehensive overview, we delve into the intricacies of Oxygen Bank, exploring its diverse range of offerings, from interest-bearing personal checking accounts to business cashback checking solutions.

What is Oxygen Bank

Oxygen Bank is a dynamic financial technology company that redefines the banking experience for individuals and businesses alike. Operating through Bancorp Bank, N.A.

Oxygen offers a range of innovative banking solutions designed to meet the diverse needs of its customers. At the core of Oxygen’s offerings is its interest-bearing personal checking account, which provides users with up to 6% cash back at select merchants, faster paydays, and widespread free ATM access.

Additionally, Oxygen caters to small business owners with its business checking account, boasting no monthly fees or minimum balance requirements and offering up to 5% cash back.

With a commitment to affordability, accessibility, and rewarding banking experiences, Oxygen Bank emerges as a leading player in the digital banking arena, reshaping the way individuals and businesses manage their finances.

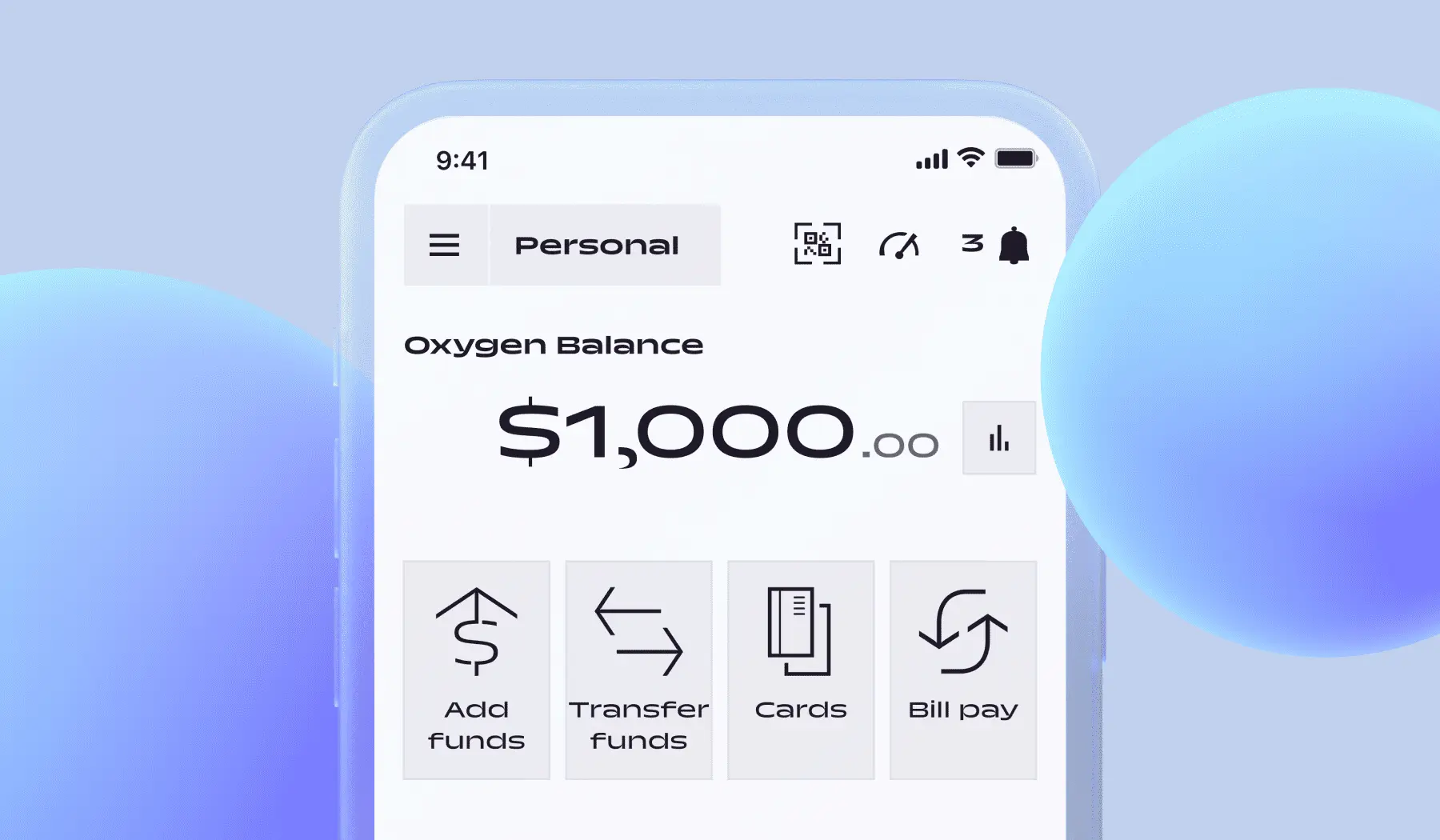

Oxygen Personal Checking Account

The Oxygen Personal Checking Account stands out as a pillar of convenience and reward in the banking landscape. Offering seamless online application and management, this account simplifies everyday banking tasks with features like online bill pay, easy transfers, and mobile check deposits.

With a straightforward fee structure and no monthly maintenance fees, users can enjoy hassle-free banking without worrying about hidden charges. What truly sets the Oxygen Personal Checking Account apart, however, is its unique cashback rewards system.

Through the Oxygen Elements Visa card, users can earn up to 6% cash back at select merchants, including popular brands like McDonald’s, Lyft, and Walmart.

The cashback percentage varies depending on the account tier, known as “elements,” with higher tiers offering greater rewards and additional perks.

Whether it’s earning cashback on everyday purchases or accessing funds faster with early direct deposits, the Oxygen Personal Checking Account offers a wealth of benefits tailored to modern banking needs.

Oxygen Savings Account

The Oxygen Savings Account offers a robust solution for individuals seeking to grow their savings with competitive interest rates and flexible features.

Available to U.S. citizens aged 18 and older, this account complements the Oxygen Personal Checking Account seamlessly. With no monthly maintenance fee or minimum balance requirement, users can start saving without unnecessary barriers.

The Oxygen Savings Account’s annual percentage yield (APY) varies depending on the account holder’s chosen “element” tier, ranging from 2.10% to 2.40%.

This competitive rate surpasses the national average, providing an attractive option for those looking to maximize their savings potential. Additionally, the account offers convenient automatic savings features, including spare change round-ups and scheduled transfers, empowering users to effortlessly build their nest egg.

Whether setting aside funds for short-term goals or long-term aspirations, the Oxygen Savings Account offers a user-friendly platform to achieve financial growth.

Oxygen Business Cashback Checking Account

The Oxygen Business Cashback Checking Account caters to entrepreneurs and small business owners, offering a rewarding and hassle-free banking experience. With no monthly fees or minimum balance requirements, this account provides a cost-effective solution for managing business finances.

The accompanying Oxygen Visa Business Debit Card unlocks up to 5% cash back on purchases from select merchants, including popular brands like FedEx, USPS, Uber, and Starbucks.

By activating cashback offers through the app, businesses can earn rewards effortlessly on their everyday expenses. Additionally, the account includes both physical and virtual debit cards, providing convenient access to funds for transactions and purchases.

Deposits can be made via various methods, including direct deposit, ACH transfers, cash transfers via Green Dot, wire transfers, and mobile deposits.

With its competitive cashback rewards and user-friendly features, the Oxygen Business Cashback Checking Account empowers businesses to optimize their finances and maximize their earnings.

Read Aslo: Activate MoneyGram with Non-VoIP Numbers

Oxygen Business Savings Account

The Oxygen Business Savings Account complements the Oxygen Business Cashback Checking Account, offering business owners a convenient way to save and grow their funds.

This account is available to U.S.-based business owners and requires an existing Oxygen Bank business checking account for enrollment.

With no monthly maintenance fees or minimum balance requirements, the Oxygen Business Savings Account provides a cost-effective solution for businesses of all sizes.

Business owners can earn a competitive 1.00% APY on balances up to $20,000, allowing them to maximize their earnings while maintaining liquidity.

The account offers optional automatic savings features, such as round-up tools for debit card spending and automatic transfers for qualifying deposits, helping businesses build their savings effortlessly.

Oxygen Goals feature allows businesses to allocate funds for specific purposes, such as quarterly taxes or future investments, further enhancing their financial management capabilities.

Deposits into the Business Savings Account can be made through manual or automatic transfers from the linked Oxygen Business Checking Account, providing seamless access to funds whenever needed.

With its attractive interest rates and flexible savings features, the Oxygen Business Savings Account empowers business owners to achieve their financial goals and secure their financial future.

How to activate Oxygen Account with Non-VoIP Numbers

Activating your Oxygen account using Non-VoIP numbers is a straightforward process that allows you to quickly access the bank’s services without the need for a VoIP number.

- Visit Oxygen Bank Website or Download Mobile App: Begin the activation process by visiting the Oxygen Bank website or downloading the mobile app from the App Store or Google Play Store. This step allows you to access the platform where you’ll set up your account.

- Provide Personal Information: During the account setup process, you’ll be asked to provide personal information, including your name, address, social security number, and date of birth. This information is necessary to verify your identity and ensure compliance with banking regulations.

- Buying Non-VoIP Number: When prompted to verify your phone number,This step is crucial for confirming your identity and ensuring that you have access to the phone number associated with your account.

- Enter Non-VoIP Phone Number: Input your non-VoIP phone number into the designated field. This can be a mobile or landline number that is not associated with a VoIP service.

- Receive Verification Code: Oxygen Bank will send a verification code to the provided phone number via SMS. This code is used to confirm that you have access to the phone number and complete the verification process.

- Enter Verification Code: Once you receive the verification code, enter it into the appropriate field in the Oxygen Bank app or website. This step confirms that you have received the code and verifies your ownership of the phone number.

- Complete Verification Process: After entering the verification code, follow any additional prompts to complete the verification process. This may include confirming your identity with other forms of identification or agreeing to the bank’s terms and conditions.

- Set Up Account Preferences: Once your account is verified, you can proceed to set up your account preferences. This includes choosing the type of account you want to open, such as a checking or savings account, and selecting any additional features or services offered by Oxygen Bank.

- Fund Your Account: Finally, you may be prompted to fund your account by depositing money into it. This can be done through various methods, such as transferring funds from another bank account or setting up direct deposit.

By following these steps, you can activate your Oxygen account using a Non-VoIP number and gain access to the bank’s services with ease.

How Oxygen Bank Compares to Other Banks

| Aspect | Oxygen Bank | Traditional Banks | Online Banks |

|---|---|---|---|

| Fee Structure | No monthly maintenance fees | Monthly fees and minimum balance reqs | Varies; often no monthly fees |

| Cashback Rewards | Up to 6% cash back for personal checking, up to 5% for business checking | Rarely offer cashback rewards | Some offer cashback or rewards programs |

| ATM Access | Surcharge-free at 40,000+ Allpoint ATMs | Limited ATM networks, may charge fees | Surcharge-free access to large ATM networks |

| Interest Rates | Competitive rates on savings accounts | Low interest rates on savings | Competitive rates on savings accounts |

| Digital Banking Experience | User-friendly mobile app and website | Limited digital services, may lack mobile app | Robust digital platforms and apps |

| Customer Service | Responsive support through website and app | In-person branches, additional support channels | Online support, phone, chat options |

| Account Offerings | Personal and business checking and savings | Variety of banking products | Personal and business accounts, CDs, MMAs |

This table provides a simplified comparison of Oxygen Bank with traditional and online banks across various aspects, helping individuals and businesses make informed decisions based on their banking preferences and needs.

Read Aslo: Activate MoneyGram with Non-VoIP Numbers

Frequently Asked Questions about Oxygen Bank (FAQ)

- Is Oxygen Bank safe?

Yes, Oxygen Bank is safe. All deposits are federally insured by the Federal Deposit Insurance Corporation (FDIC) up to the maximum permitted limit of $250,000 per depositor, per account ownership category. Oxygen bank accounts are issued through Bancorp Bank, N.A. (FDIC #35444). - How do you add money to an Oxygen bank account?

There are several ways to deposit money into your Oxygen checking account. These include direct deposit, ACH transfer from an external bank account, cash deposit via Green Dot, wire transfer. ATM cash deposits are not available. - Where can I get money off my Oxygen card for free?

You can withdraw money from your Oxygen personal checking account for free at domestic Allpoint ATMs, which can be found in many popular retailers including Target, CVS, and Speedway.

In conclusion

Oxygen Bank stands out as a versatile and user-friendly option for both personal and business banking needs. With features like no monthly fees, competitive interest rates, and convenient access to a large network of surcharge-free ATMs, Oxygen offers a compelling banking experience.

While it may not have physical branches and has certain limitations such as no joint accounts and foreign transaction fees, its strengths outweigh its drawbacks for many users.

Whether you’re an individual looking for rewarding checking and savings accounts or a small business owner seeking affordable banking solutions, Oxygen Bank provides a solid option in the digital banking landscape.

As always, it’s essential to assess your specific banking needs and compare them with Oxygen’s offerings to determine if it’s the right fit for you.

Blog Non-VoIP

Blog Non-VoIP