Say goodbye to manual logins and complex spreadsheets! Now, with the ability to link your current bank account to the Baselane digital bank, activating a new account is easier than ever.

But what is Baselane bank? What services does it offer? What are its features? And how does Baselane differ from Paypal?

In this article, we will explore the complete information on this topic, focusing on the easiest way to activate a Baselane digital bank account and profit from it.

What is Baselane Bank?

If you use the internet for your financial transactions and business activities, you likely have important financial data. Employing accountants and paying for multiple software subscriptions may not be logical.

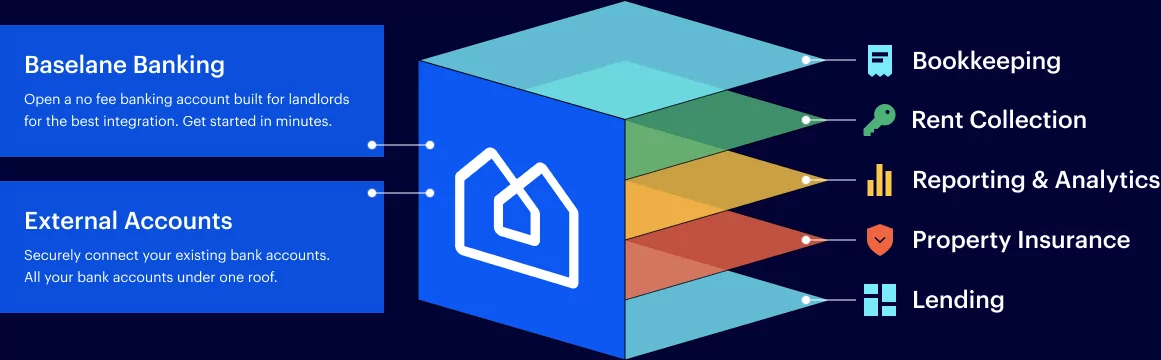

This is where Baselane bank comes into play. It is a comprehensive digital bank that includes six essential tools for managing and growing your investment portfolios.

Whether you are considering real estate investment or managing your digital portfolio, Baselane bank is the ideal choice.

Importance of Baselane Digital Bank

Baselane Bank is a financial operating system and banking platform designed to benefit independent real estate owners.

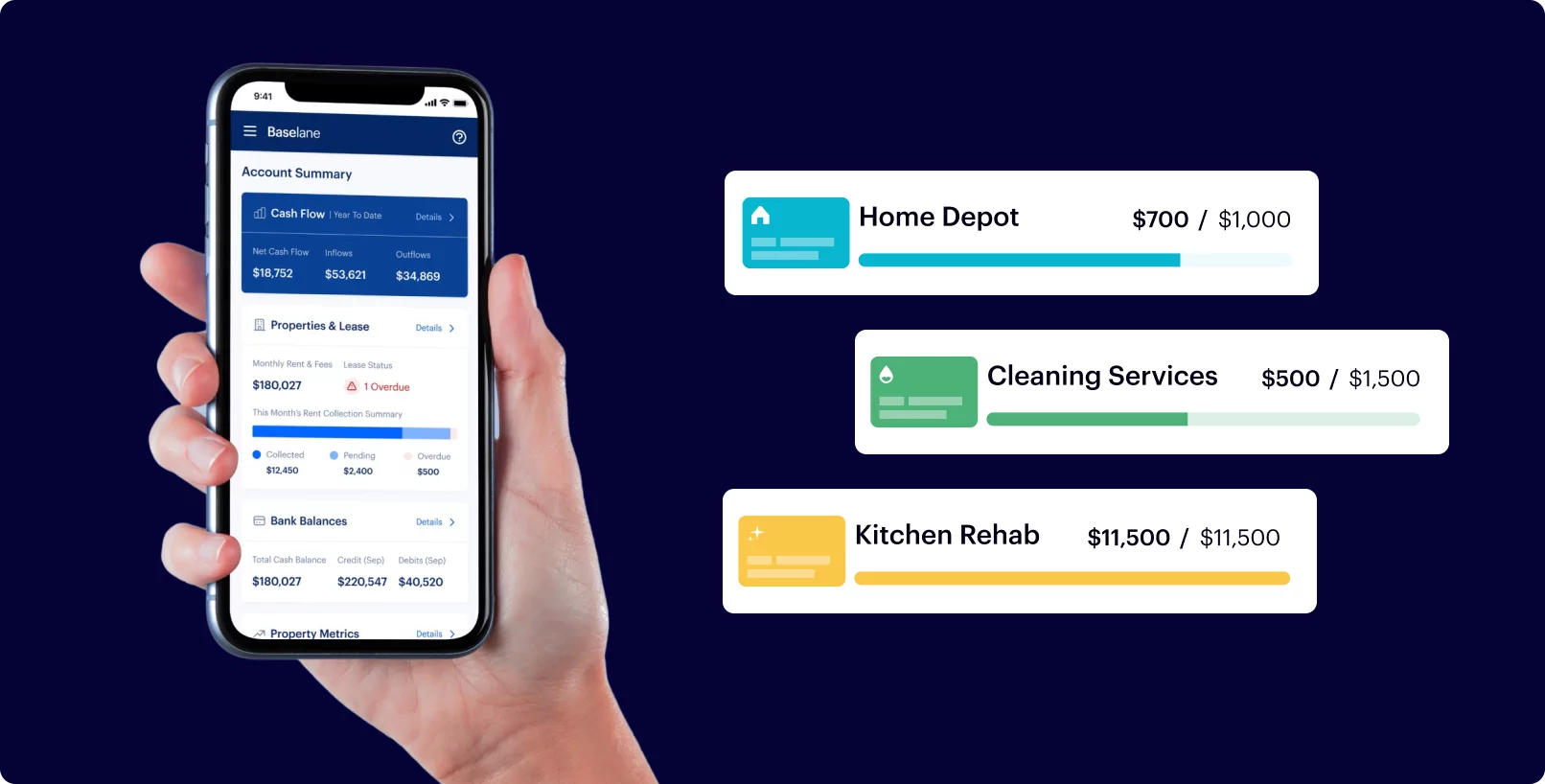

This digital bank aims to provide a range of financial services to independent users, along with automated tools and executable data to save time, increase returns, and grow digital investment portfolios.

The key importance of Baselane bank includes:

- Serving thousands of real estate owners, allowing the company to offer a complete range of financial products.

- Providing an integrated financial solution designed specifically for real estate owners, offering free products such as rental collection options and free banking transaction checks.

- Offering various paid products, including loans for real estate owners, insurance, and integrated platform services.

- Taking responsibility for meeting the financial and banking needs of independent real estate owners, designed as a comprehensive financial solution.

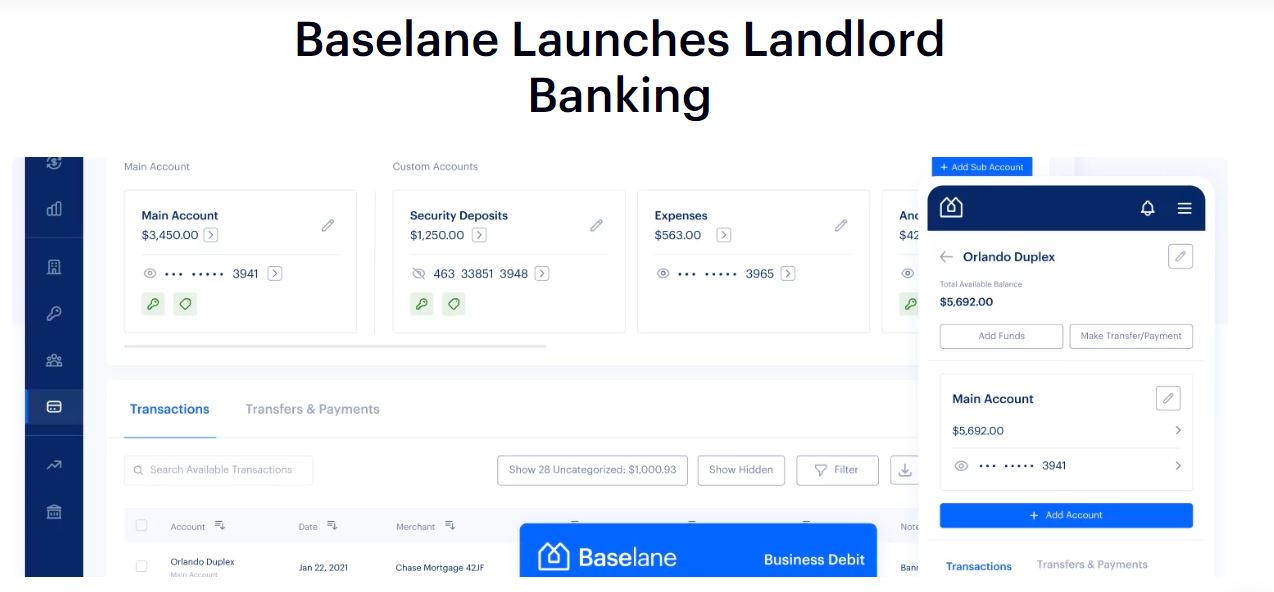

Baselane Digital Bank includes a business verification account, providing a free check designed for real estate owners.

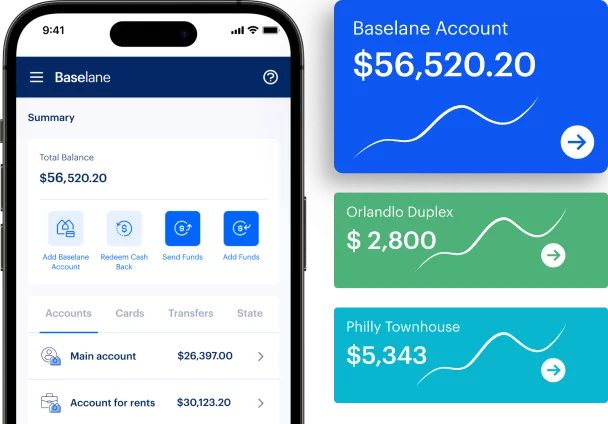

It allows them to divide income and expenses according to properties within virtual accounts, tracking insurance deposits to tailor the way you manage your funds.

Read Also: SwagBucks Website Explained: How to Earn and Withdraw

Ways to Profit from Baselane

Many users, especially real estate owners and managers, are eager to open a bank account with Baselane and start making a profit. But how can you profit from this digital bank?

Baselane Bank is a digital solution online, logical only for real estate owners or real estate investors with multiple properties. It offers competitive cashback on purchases and interest rates that exceed the national average by a significant margin.

Moreover, the bank’s ability to manage every part of the rental process makes it a suitable choice for those within the mentioned categories. If you are interested in experiencing Baselane’s profit, you can create an account, use it to generate profit, as the bank provides virtual accounts to manage each rented property easily. You can also access a high-yield current account and a Baselane debit card.

Additionally, the bank supports rent payments through debit cards, credit cards, and ACH.

How to Activate Baselane Digital Bank Account

If you are interested in activating your own account in Baselane digital bank, you can subscribe by entering your email, phone number, and password. Once registered, you can link your bank accounts to this digital bank. You can start receiving rent by logging into the bank’s website, providing tenant contact information, and details of the account where Baselane stores rental returns.

You can also open a current account or get a loan by providing personal information and documentation. Please note that loans may require some documents and proofs, such as ownership proof or property valuation.

If you reside in a country where activating this account is restricted, you can use the services of the Non-Voip website. It offers ready and efficient American numbers for sale, as well as paid subscriptions to create a ready-made account on Baselane and benefit from the bank’s services.

Difference Between Baselane and Paypal

After learning more about Baselane digital bank’s features, we can identify several differences between it and the well-known Paypal bank.

The key differences include:

- Baselane’s cost is lower than Paypal for rent collection. Although Paypal can be used for rent payments, it charges high fees for features like automatically recurring payments. Baselane, on the other hand, does not impose any fees.

- Baselane allows users to make one-time payments or set up automatic payments for recurring deductions from their bank accounts. In contrast, Paypal’s recurring invoices (requires an upgrade to a business account) charge fees of 3.49% + $0.49 per transaction.

- Both Paypal and Baselane offer useful features for rent collection, providing flexibility and ease for tenants in their payment methods.

- Both platforms assist in solving problems related to transferring money from your tenant’s bank account to your account. Paypal requires a lot of manual work for rent collection, while Baselane is specifically designed for real estate owners, making the rent collection process easier and more automatic.

Features of Baselane Digital Bank

In addition to its significant importance and profit potential, Baselane Digital Bank includes a range of features that make it one of the best digital banks for independent users.

The main features include:

- Offering various types of accounts such as rental collection options and a free business current account.

- No minimum initial load requirement ($0).

- Supporting Apple and Google Play stores with an easy digital experience.

- Cashback of up to 5% on debit card spending.

- No monthly fees or ACH transfer fees.

- Supporting direct deposit.

- Highly secure, facing all forms of account and financial data fraud.

- Allowing you to link your bank accounts to Baselane, as well as your external accounts.

- Providing simple and immediate financing and security for your business, reducing costs and increasing returns.

- No minimum deposit or balance requirement.

- Offering a property-specific account.

This concludes our article on Baselane Digital Bank, discussing how to benefit from it and the features it provides to real estate owners and managers looking to profit easily and reliably. Are you considering using this platform?

We hope at Non-VoIp Blog that we have answered all your questions and clarified the importance of this bank. If you have any questions or inquiries, feel free to add them in the comments, and we will respond directly.

Blog Non-VoIP

Blog Non-VoIP