In an era defined by global connectivity, the need for swift, secure, and convenient money transfers transcends borders.

Enter MoneyGram, a powerhouse in the realm of international financial transactions.

Boasting a vast network of over 505,000 agent locations across 200 countries, MoneyGram stands as a beacon for individuals seeking to send and receive funds with unparalleled ease.

This article delves into the key features, benefits, and drawbacks of MoneyGram, unraveling its rich history, recent initiatives, and future growth directions.

As we navigate the intricate landscape of global finances, we’ll also guide you through the process of activating your MoneyGram account using Non-VoIP numbers, ensuring a seamless and secure entry into the world of international money transfers.

Key Features of MoneyGram

A global stalwart in the realm of money transfers, presents a constellation of features that distinguish it as a leader in international financial services.

With a colossal network spanning over 505,000 agent locations worldwide, MoneyGram ensures unparalleled accessibility for users.

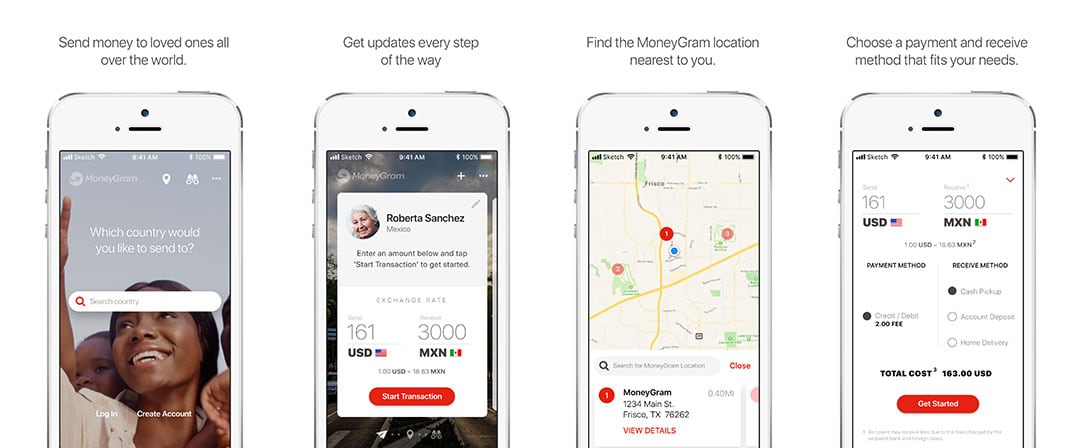

Convenience takes center stage as the platform offers multiple avenues for sending and receiving funds, including online channels, mobile applications, and physical retail locations.

Operating with competitive rates, MoneyGram facilitates quick and secure transfers, often completing transactions within 24 hours.

However, the true hallmark lies in its adaptability, allowing users to dispatch funds to diverse recipients, be it bank accounts, mobile wallets, or convenient cash pick-up locations.

As we navigate the landscape of MoneyGram key features, a world of global financial connectivity unfolds, providing users with a comprehensive and user-centric money transfer experience.

Read Also: What is the Non-voip Site for American Numbers and How to Use It

Benefits of Using MoneyGram

- Swift and Reliable: MoneyGram ensures rapid transaction processing, guaranteeing the prompt delivery of funds to their destination.

- Security at the Core: With bank-level security measures, MoneyGram prioritizes the protection of users’ money and personal information, fostering a secure financial ecosystem.

- Versatility in Recipients: Users can send money to various recipients, including bank accounts, mobile wallets, and convenient cash pick-up locations, showcasing the platform’s flexibility.

- Global Connectivity: Operating in over 200 countries and territories, MoneyGram provides a global reach that aligns with the interconnected nature of today’s world.

With these benefits, MoneyGram stands as a beacon of efficiency and reliability in the realm of international money transfers.

Read Also: how to activate opinion outpost account with Non-VoIP number

Additional Details about MoneyGram

- Founded: 1940

- Headquarters: Dallas, Texas, United States

- Global Presence: Available in over 200 countries and territories

- Currency Support: Over 150 currencies

- Payment Methods: Online transactions, mobile app usage, and retail locations

This information offers insights into Money Gram extensive history, its base of operations, the widespread availability of its services, the diverse range of supported currencies, and the convenience of different payment methods.

Read Also: Top 5 Online Survey Websites and How to Activate Them with Non-VoIP Numbers

How to Activate MoneyGram with Non-VoIP Numbers

Activating the account with Non-VoIP numbers involves a straightforward process that ensures security and accessibility.

Follow these steps to initiate the activation seamlessly:

- Register for a MoneyGram Account: Begin by creating an account on the official website or mobile app. Provide the necessary details for account registration.

- Choose Non-VoIP Number: Visit the official Non-VoIP website.

- Login or Register: If you have an existing account, log in. Otherwise, create a new account quickly and easily. numbers specifically for MoneyGram verification.

- Find MoneyGram Numbers: Use the search function on the main interface to find temporary phone numbers specifically for MoneyGram verification.

- Verification Process: MoneyGram may prompt you to verify your identity using various methods, including document verification and facial recognition. Ensure you follow the instructions accurately.

- Link Non-VoIP Number: In the account settings, link your chosen Non-VoIP number to your MoneyGram account. This step is crucial for account recovery and additional security measures.

- Receive Activation Code: MoneyGram may send an activation code to the linked Non-VoIP number. Enter the code promptly to verify and activate your account.

- Secure Your Account: Set up additional security measures, such as a strong password and two-factor authentication, to enhance the safety of your MoneyGram transactions.

By utilizing a Non-VoIP number during the activation process, you ensure a reliable and secure connection to your MoneyGram account, contributing to a seamless and protected financial experience.

MoneyGram Future Directions

As Money Gram continues to shape the landscape of global money transfers, several key directions and initiatives pave the way for its future growth and impact:

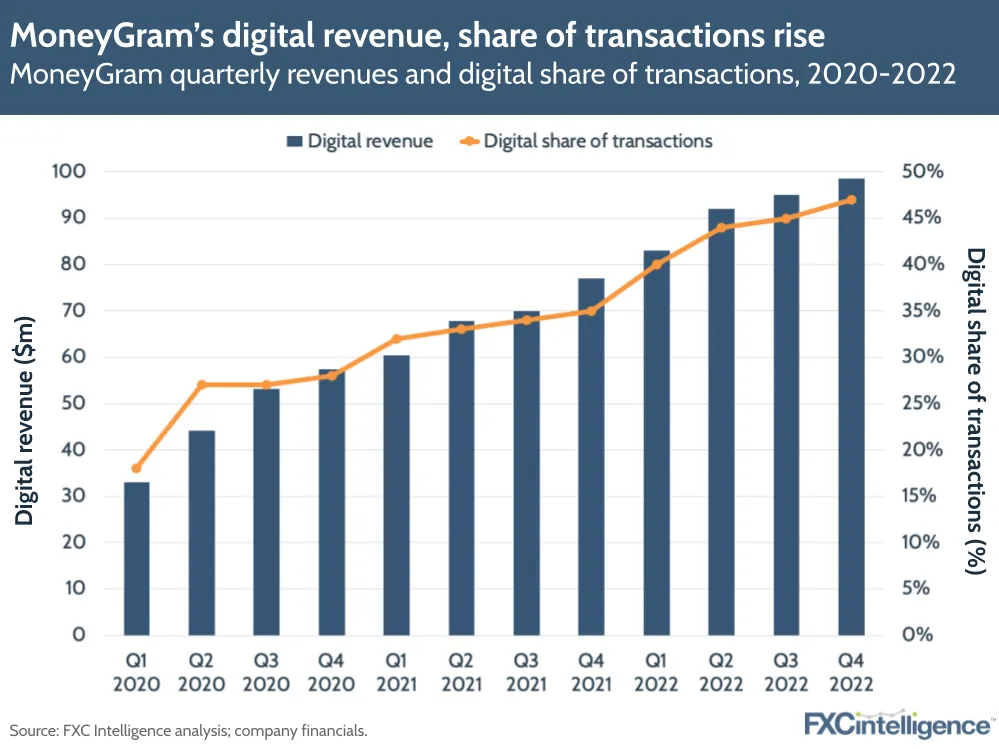

- Digital Transformation: Money Gram is actively investing in its digital platform, aiming to enhance user experience and convenience in online and mobile transactions. The ongoing digital transformation aligns with the evolving preferences of consumers for seamless and efficient money transfers.

- Global Expansion: To meet the increasing demand for cross-border money transfers, Money Gram is strategically expanding into new markets. The company’s global network, coupled with partnerships with financial institutions, positions it to tap into diverse regions and serve a broader customer base.

- Innovative Partnerships: Money Gram’s collaborations with major financial institutions and technology giants underscore its commitment to innovation. These partnerships enable the integration of advanced technologies, ensuring that MoneyGram remains at the forefront of secure and efficient money transfer services.

future directions reflect its adaptability to technological advancements, commitment to customer-centric solutions, and a strategic approach to global expansion.

As the financial landscape evolves, Money Gram stands poised to continue its impactful journey in facilitating secure and efficient cross-border money transfers.

In conclusion

Money Gram stands as a formidable player in the global money transfer arena, offering a reliable and expansive network for individuals seeking secure and efficient cross-border transactions.

With a rich history dating back to 1940, Money Gram has evolved into a versatile financial platform with a global presence, encompassing over 505,000 agent locations across more than 200 countries.

The key features of Money Gram, including its global reach, convenience, and competitive rates, position it as a preferred choice for users navigating the complexities of international money transfers.

Despite certain limitations, such as limited exchange rate options, Money Gram remains a valuable resource for those prioritizing swift and secure financial transactions.

Take the next step with Money Gram and experience the ease of global money transfers.

Initiate your secure transaction today. Your world, your money, with Money Gram.

Read Also: Discover How to Maintain Your Privacy While Completing Online Surveys

Blog Non-VoIP

Blog Non-VoIP